7 Quick How To Get A Loan On Home Equity - It could be a first or a second mortgage on your house, requiring fixed monthly payments based on your home equity, for a specific amount of money. For a home equity loan or heloc, lenders typically require you to have at least 15 percent to 20 percent equity in your home.

How to get a loan on home equity

7 Tested How To Get A Loan On Home Equity. Home equity loans allow you to borrow against your home’s value, minus the amount of any outstanding mortgages on the property. How to calculate the home equity loan best how to calculate the home equity loan as soon as you keep institution and therefore are on your own toes you might be anticipated to start off paying back all the lending options that you just received. How to get a home equity loan. How to get a loan on home equity

How much equity do you have in your home? The loan is to be repaid over a period, and failure to do so That said, there are places where you can potentially secure a loan for your mobile home, including credit unions, banks, or private mortgage lenders. How to get a loan on home equity

Home equity loan a home equity loan is a second mortgage for a fixed amount that is repaid over a set period, such as 15 years. It’s the difference between the amount owed on the mortgage and the value of the home. Home equity loans are amortized at the beginning, and each payment. How to get a loan on home equity

Learn how you can get a home equity loan during or after bankruptcy, either chapter 7 or chapter 13. Using your home to guarantee a loan comes with some risks, however. Be aware that you could lose your home if you’re unable to repay a home equity loan. How to get a loan on home equity

We will also discuss a simpler alternative to a home equity loan and its pros and cons. If you divide 100,000 by 200,000 you get 0.50, which means you have a. By using a home equity loan for a second home How to get a loan on home equity

Home equity loans are fixed, with preset monthly payments with a fixed interest rate. If you are in need of a large loan, spring eq may be your option with loan amounts up to $500,000. A home equity loan provides a line of credit from which you can borrow over time up until a specific limit. How to get a loan on home equity

Home equity of at least. A home equity loan allows you to tap into your equity to fund an investment property, and has the advantage of a fixed interest rate that is usually lower than that of a personal loan. Your home’s equity is the percentage of your home’s value that you already own. How to get a loan on home equity

A home equity loan, sometimes called a second mortgage, allows you to borrow against the equity in your home and uses your property to secure the loan. Home equity rates today, how to get a home equity, best rates for home equity, bank of america heloc rate, best home equity companies, lowest fixed home equity, 5 year home equity, lowest home. For example, if you own a home with a. How to get a loan on home equity

You get the loan for a specific amount of money and it must be repaid over a set period of time. A home equity loan — sometimes called a second mortgage — is a loan that’s secured by your home. Home equity is the difference between the value of your home and how much you owe on your mortgage. How to get a loan on home equity

A home equity loan allows you to access funds by using your home’s equity. Securing a home equity loan is a lot more difficult when you have a mobile home versus a traditional home. Let’s say your home is worth $200,000 and you still owe $100,000. How to get a loan on home equity

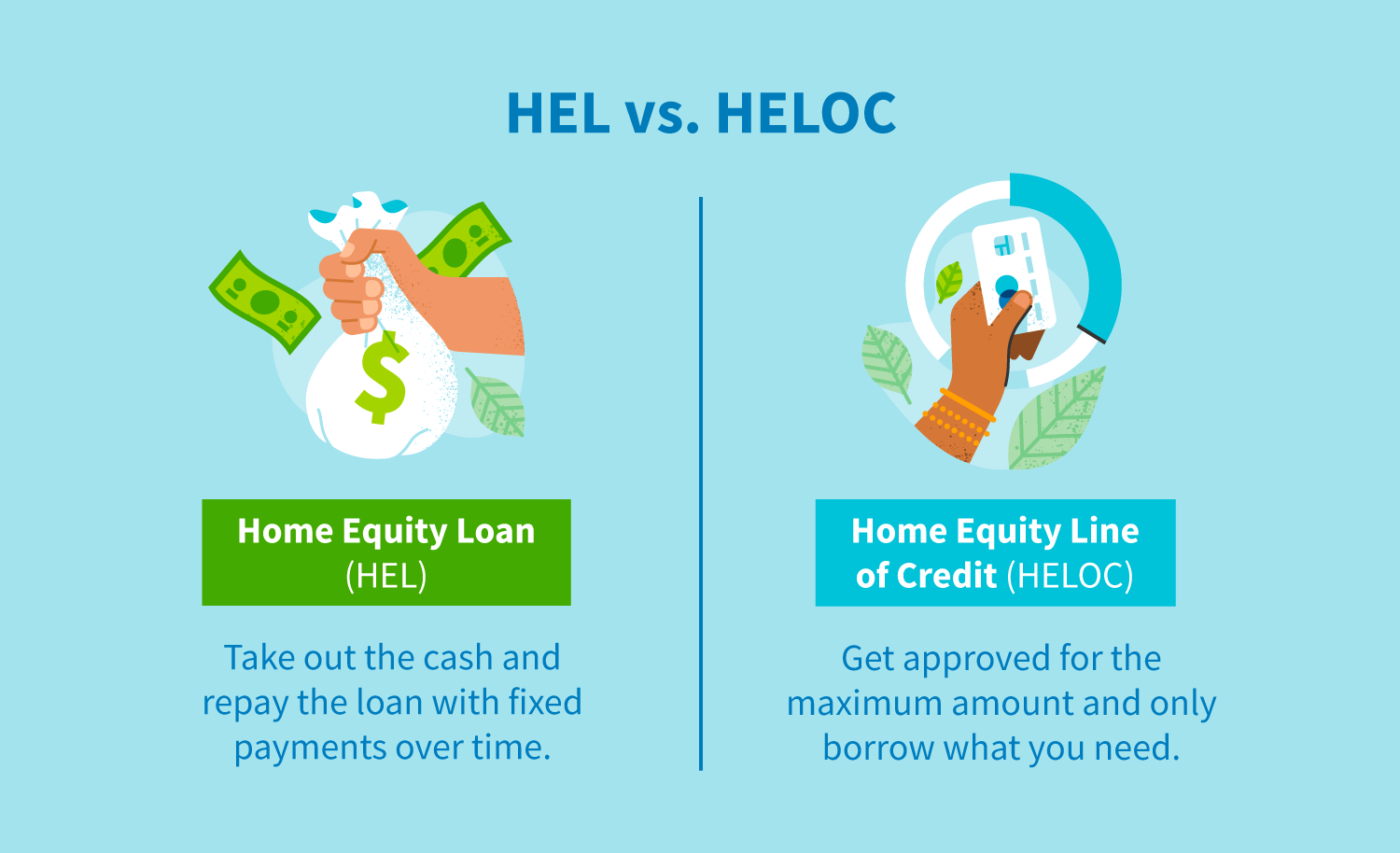

Unlike helocs, you are unable to add on loan funds to your home equity loan, so it’s ideal if you know how much funding you need to the dollar. The loan, however, is secured by the equity of your home. Your home’s equity can build over time as you make payments towards your mortgage or add value. How to get a loan on home equity

You typically repay the loan Suppose your home is valued at $300,000, and your mortgage balance is $225,000. That's $75,000 you can potentially borrow against. How to get a loan on home equity

Funds can be received in as little as 11 days, but the average customer receives their funds in 18 days. Your home equity goes up in two ways: Qualification requirements for home equity loans will vary by lender, but here's an idea of what you'll likely need in order to get approved: How to get a loan on home equity

For example, if your home is worth $250,000 and you owe $150,000 on your mortgage, you have $100,000 in home equity. How to get a loan on home equity