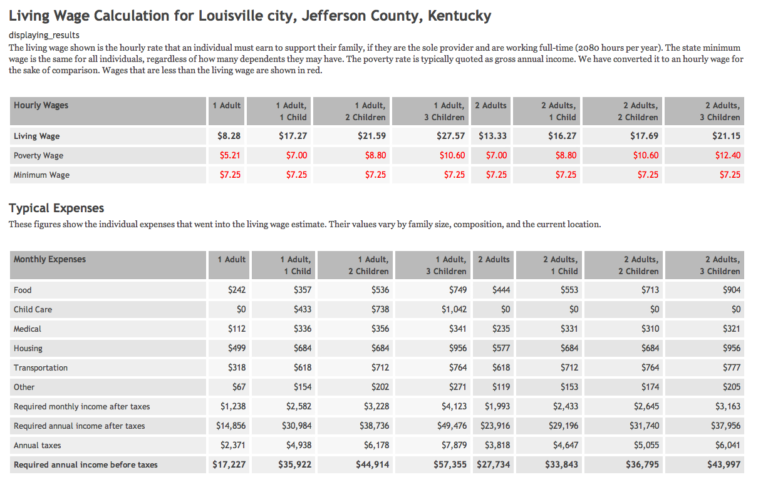

13 Fundamentals How To Calculate Your Paycheck - This includes both state and federal taxes. If you would like the paycheck calculator to calculate your gross pay for you, enter your hourly rate, regular hours, overtime rate, and overtime hours.

35 Calculating Your Paycheck Worksheet Free Worksheet . But do you know what is

35 Calculating Your Paycheck Worksheet Free Worksheet . But do you know what is

How to calculate your paycheck

5 Hoak How To Calculate Your Paycheck. For example, if an employee makes $40,000 annually and is paid biweekly, divide their annual wages ($40,000) by 26 to get their total gross pay for the period ($40,000 / 26 = $1,538.46). Fill in the employee’s details. Once you’ve gone through the previous eight steps and have figured out your gross income, withheld taxes, and other deductions, you have all you need to calculate your paycheck. How to calculate your paycheck

To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. This is also an important part of filling out your tax return. Small businesses need to calculate withholding tax to know how much money they should take from employee paychecks to send to the internal revenue service to cover tax payments. How to calculate your paycheck

This is how you calculate your paycheck: This gives you $12,500, which you input into the “average monthly payroll” box on your ppp application. This free paycheck calculator makes it easy for you to calculate pay for all your workers, including hourly wage earners and salaried employees. How to calculate your paycheck

You can find the amount of federal income tax withheld on your paycheck stub. If your employer compensates you as a salary, divide your annual salary by 52 and get your gross weekly pay. After all those steps above, you may subtract the total taxes from your gross income from the number you got from your pretax deductions, your other remittances. How to calculate your paycheck

This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. Let’s say your total 2019 payroll costs, including your salary, comes to $150,000. This includes just two items: How to calculate your paycheck

Contributing 5% instead of 1% reduces your paycheck by $33 column graph: Let’s start by adding up your expected tax withholding for the year. How to calculate your paycheck this free paycheck calculator makes it easy for you to calculate pay for all your workers, including hourly wage earners and salaried employees. How to calculate your paycheck

Multiply $12,500 by 2.5 to find your “loan request” amount. The sum of these is your net come for the year. That would be $3,600 in taxes withheld each year. How to calculate your paycheck

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local w4 information. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Contributing 5% instead of 1% reduces your paycheck by $33. How to calculate your paycheck

How to manually calculate a paycheck creating a budget is a responsible decision. For example, if an employee earns $1,500 per week, the individual’s annual income would be 1,500 x 52 = $78,000. In this case, it’s $31,250. How to calculate your paycheck

Total up your tax withholding. Generally, there are a few taxes you need to calculate to process payroll correctly, including: Please use the calculator's report to see detailed calculation results in tabular form. How to calculate your paycheck

By calculating your paycheck, you can determine the amount of money you will have and designate it to specific bills and savings. A w2 is a tax form that lists the total amount of taxes that have been withheld from your paycheck that year. Their name and the state where they live. How to calculate your paycheck

Click the terms tab above for a more detailed description of each entry. Federal income tax (fit) social security tax. The total 401 (k) contribution from you and your employer would therefore be $13,000. How to calculate your paycheck

Let’s say you have $150 withheld each pay period and get paid twice a month. How do you calculate your scentsy paycheck? What percentage do i get paid at, and do i get paid off my frontline or downline? How to calculate your paycheck

Nanny Payroll Spreadsheet intended for Paycheck Calculator . What percentage do i get paid at, and do i get paid off my frontline or downline?

Nanny Payroll Spreadsheet intended for Paycheck Calculator . What percentage do i get paid at, and do i get paid off my frontline or downline?

How to add a new payroll deduction and withhold it from . How do you calculate your scentsy paycheck?

FREE 12+ Paycheck Calculator Samples & Templates in Excel . Let’s say you have $150 withheld each pay period and get paid twice a month.

FREE 12+ Paycheck Calculator Samples & Templates in Excel . Let’s say you have $150 withheld each pay period and get paid twice a month.

![Free Paycheck Calculator Hourly & Salary [USA] DrEmployee](https://dremployee.com/images/USA-Paycheck-calculator.png) Free Paycheck Calculator Hourly & Salary [USA] DrEmployee . The total 401 (k) contribution from you and your employer would therefore be $13,000.

Free Paycheck Calculator Hourly & Salary [USA] DrEmployee . The total 401 (k) contribution from you and your employer would therefore be $13,000.

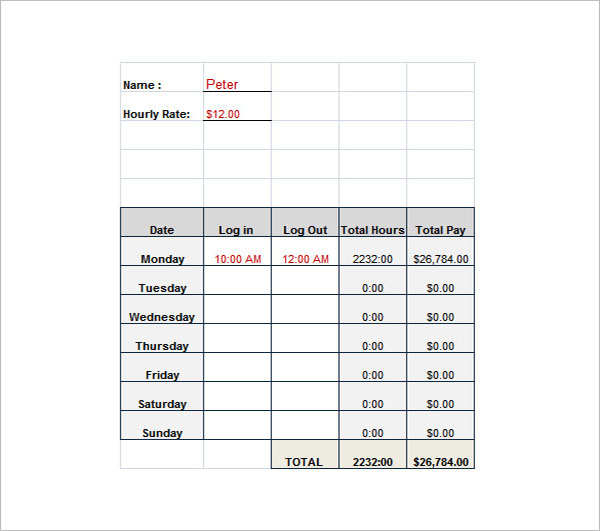

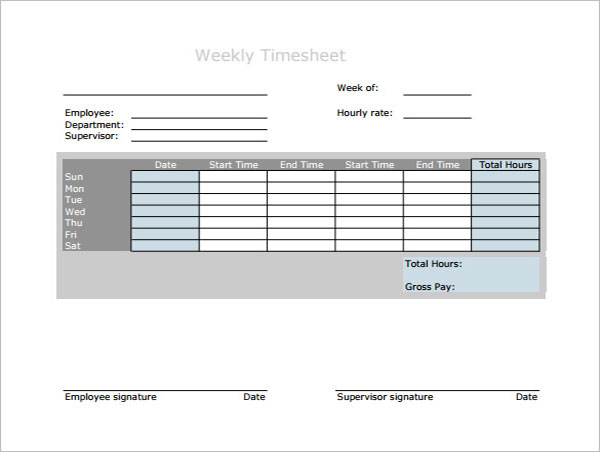

11+ Free Weekly Paycheck Calculator Excel, PDF, Doc, Word . Federal income tax (fit) social security tax.

11+ Free Weekly Paycheck Calculator Excel, PDF, Doc, Word . Federal income tax (fit) social security tax.

How to Calculate & Process Retroactive Pay . Click the terms tab above for a more detailed description of each entry.

How to Calculate & Process Retroactive Pay . Click the terms tab above for a more detailed description of each entry.